GS1 US and 1SYNC have made remarkable progress, and much more is yet to come.

This article provides an update on the status of GS1 standards-based initiatives from January 2011 to February 2012 and also looks at plans for the coming year. Special attention is given to the broadening focus of 1SYNC, which is now not only the world's leading Global Data Synchronization Network (GDSN) certified data pool, but also a leader in the area of Product Data Management. In line with this shift, I note the important improvement of GS1 US's capabilities in helping industries and enterprises benefit from the real world implementation of standards.

As this article went to print, GS1 US announced with GS1 Germany that they had signed a letter of intent to combine 1SYNC with GS1 Germany's SA2 Worldsync in a joint venture. The two companies together serve more than 15,000 companies in more than 40 countries.

GS1

GS1 US is an information standards organization. At the time of my last article, GS1 US had recently hired CEO Bob Carpenter. Carpenter had just undertaken ambitious plans to upgrade the executive team at all GS1 US companies and bring clear, concise focus to the world's most important commercial standards organization with his "Focus Five" plan: Community Enablement, Sector Focus, Data Quality, Fresh Food, Breakthrough Projects.

Carpenter reviewed advances against last year's Focus Five and this year's "Five Strategies" in an interview with me on February 9, 2012. Much of the information in this segment of the article comes from that interview.

At a high level, GS1 US is performing well. Against the backdrop of a tough economy, GS1 US increased membership 5%, experienced its highest client-retention rate in history, grew its 1SYNC subsidiary's revenues 13%, and created and implemented a new Advisory Services practice to better help customers and industries drive and adopt GS1 standards in their companies and supply chains. This Advisory Services practice is very important because it takes the idea of standards and brings the implementation and benefits to life in real companies. GS1 US came into the year with a goal of running 15 major projects in 2011 and ended up delivering 32, which indicates the market's desire for this real-world expertise.

There have been significant advances in most of the Focus Five areas. 1SYNC's Data Quality Scorecard has helped advance best practices across these areas, with major participation from leaders like Walmart, Heinz, and McLane (several case studies are available on the GS1 and 1SYNC sites). Community enablement has never been better. Organizations like GS1 Healthcare and GS1 Foodservice are working to ensure industry-specific needs are met with a base of GS1 standards. In many cases, local U.S. efforts are being coordinated with worldwide standards activities.

Nowhere is this more visible and more important than in healthcare, where GS1 is working closely both with the U.S. Food and Drug Administration to support the Unique Device Identification (UDI) initiative and with state governments to support their initiatives relative to serialization and pedigree. These important initiatives will impact the safety of healthcare consumers worldwide in a very positive way—i.e., the abilities to effectively track devices implanted in the human body and know the pedigree of the medications we use.

For 2012, Carpenter has outlined key strategic areas called "Five Strategies" and "Five Industries" for GS1 US focus. This article examines these industry initiatives.

The five strategies include the following:

- Identification—Product and Location

- Traceability and Safety

- Inventory Efficiency

- Data Quality and Data Management

- B2B2C

The five industries GS1 US will be focusing on are these:

Apparel/General Merchandise—The Electronic Product Code (EPC) to enable item-level RFID has been discussed for years, but it's really happening now. Technical issues surrounding tag reads of liquids and metals are largely resolved. Gen 1 tag prices are down, as are reader prices. Volumes will grow fourfold over the next three years.

EPC-enabled RFID now provides a great business case. At a recent presentation at the National Retail Federation Show (January 2012, NY, NY), Macy's CIO Tom Cole reported that the time it takes for an associate to take inventory using RFID compared to normal bar code scanning is 95% less. This allows a retailer to keep inventory accuracy at or above 95% by doing inventory 24 times a year.

Consumer Packaged Goods (CPG)/Grocery—The advance in CPG is the continued adoption of GS1 Item Alignment via the GDSN. More major retailers are coming on board in a big way (Walmart, Kroger, Sears, etc.), driving adoption even deeper in this industry. From a global perspective, it is my opinion that major international corporations like Tesco and Sainsbury's are seriously looking at GS1 Item Alignment via GDSN. There is significant activity in the area of measuring data in the GDSN against Cubiscan data to look more closely at data quality, resolve errors, and develop best practices that all industries and participants can benefit from.

Foodservice—The foodservice industry started adoption of the GS1 system and synchronization of product and trading partner information well after CPG did. Recently, due to issues of food safety and the difficult economy, participants in this industry have become more focused on the issue of Stock Keeping Unit (SKU) quality. Because the basic elements of the GS1 system—Global Trade Item Number (GTIN), Global Location Number (GLN), GS1 keys in EDI transmissions—are less widely adopted here, there is significant opportunity to improve SKU quality by deeper adoption of the GS1 system and use of the standardized identifiers in the ordering and distribution processes.

Consolidation of market participants continues in foodservice. Thus the size, complexity, and technical capabilities of industry participants are increasing, allowing more rapid and broad adoption of GS1 standards and GDSN-based synchronization. One of the most exciting opportunities here is the broadening use of "Phase Two Nutritional Attributes." Increasing adoption of these attributes is clearly beneficial to consumers—i.e., they know exactly what's in the food they purchase in restaurants. This trend offers not only better purchasing capabilities for operators (restaurant chains) because they know exactly what's in the meals they prepare and serve, but also enhanced marketing opportunities as they can accurately present, advertise, and market things like "gluten-free," etc.

Hardlines—The focus here is on enhanced Product Master Data Management. Key industry participants want a single item file of product information for both brick-and-mortar stores and online e-commerce requirements. Efforts are around streamlining the introduction of this capability. Lowe's has deployed 42,000 mobile devices, including iPhones, to more than 1700 stores. These devices require truly accurate product data for in-store staff to add value to the consumer buying experience. I read in an article in Retail Information Systems News that Lowe's CEO Robert Niblock said, "Our goal is to make home improvement simple for customers and for our employees. Leveraging Apple's iPhone technology, our employees will check inventory availability, access how-to videos, and utilize lowes.com from the aisles of the store."

Healthcare—Healthcare continues to advance with deepening adoption of the GS1 system. The GLN has become the virtual standard for identifying trading partners. Adoption of the GTIN as the unique identifier for products has continued to move forward with many endorsements from key industry participants, which are available for review on the GS1 Healthcare Web site.

The biggest event in this industry is the likely release of federal regulation regarding UDI. The UDI initiative will make the ability to track devices implanted in the human body much easier. This is not an RFID/EPC type of application or implementation, but rather a database that will provide critical information in the event it is needed for recall or consumer safety issues. The basis for this database is likely to include the use of the GS1 standards, such as GTIN and GLN. Regulations for serialization and pedigree that take effect in 2015 are also driving significant advances in GS1 system-related adoption in this industry.

Carpenter says, and I agree, "If I was a healthcare manufacturer, distributor, or medical service provider (hospital), I would think hard right now about how to use standards to control costs and meet likely-to-come regulatory requirements in the USA and around the world."

About Unique Device Identification (UDI)

The U.S. Food and Drug Administration Web site says this about UDI:

"On September 27, 2007, the Food and Drug Administration Amendments Act of 2007 was signed into law. This act includes language related to the establishment of a Unique Device Identification system. This new system when implemented will require:

- the label of a device to bear a unique identifier, unless an alternative location is specified by FDA or unless an exception is made for a particular device or group of devices

- the unique identifier to be able to identify the device through distribution and use

- the unique identifier to include the lot or serial number if specified by FDA"

The most recent conference on this topic was November 30, 2011. Shortly thereafter, GS1 Healthcare held an excellent Webinar on December 8, 2011, hosted by John Roberts, Director, GS1 Healthcare. In the Webinar, Roberts presented the steps to developing a UDI system, the anticipated UDI database key elements, the expected implementation schedule, and the likely limitations of UDI. This information is subject to change based upon the final FDA regulation.

These are the four steps Roberts identified toward evolving the UDI system:

- Develop a standardized system to create the Unique Device Identification (UDI)

- Place the UDI in human-readable form and/or AutoID on a device, its label, or both

- Create and maintain the UDI database

- Adopt and implement

The key elements that Roberts identified for the UDI database include the following:

- Device identifier type/code—GTIN or Health Industry Business Communications Council (HIBCC)

- Make/model, brand/trade name, size, description

- Device model number (or reference number)

- Unit of measure, packaging level, quantity

- Control method: lot and/or serial number, expiration date

- Contact name, phone, email

- Global Medical Device Nomenclature (GMDN) classification code/term

- Storage condition, single use, sterility

- Presence of known, labeled allergen (e.g., latex)

- FDA premarket authorization (510k, PMA)

The anticipated UDI implementation schedule is based on pre-market risk class: Class III (implants) 12 months after final rule, Class II (equipment) 36 months after final rule, and Class I (disposables) 60 months after final rule. The plan allows stakeholders to jointly learn about and prepare for mid-course corrections. The current national numbering system (NDC/NHRIC) will be phased out. A robust alternate placement and exception process will be in place.

It's important to understand the differences between UDI and UDID. UDI is a foundational element. It unambiguously identifies a specific device (at its unit of use). Benefits accrue only if it's used by all stakeholders. UDID contains only "static" identifying and product information. It does not contain production information, such as lot or serial numbers, and is not for tracking, tracing, or other similar purposes requiring the full UDI. UDID provides a link to product information. It's not a replacement for recalls/adverse event databases.

Worth noting is the January 2012 release of the case study "Perfect Order and Beyond." This document shows how BD (Becton, Dickinson and Company) and Mercy (along with its supply chain company, ROi) implemented GS1 standards at each step—from manufacturing to patient bedside. The paper details significant benefits, including those associated with patient safety and an optimized supply chain. The paper claims, "This end-to-end global data standard integration represents the first known instance in the United States that a healthcare provider and manufacturer used the Global Location Number (GLN) and Global Trade Item Number (GTIN) in both supply chain and clinical processes, achieving fully automated, accurate electronic processing of order transactions known as Perfect Order."

1SYNC

1SYNC now operates under the executive guidance of president Bill Voltmer. Voltmer has a deep ERP background and a strong management background, which has proven to be a major benefit for 1SYNC's customers. He has strengthened 1SYNC by putting the right people in charge of business development, customer management, and marketing (Ruben Castano, Luiz Martins, and Dan Wilkinson, respectively) and bringing on a talented new executive (Ali Moosani) to lead Professional Services.

1SYNC continues to be the world's leading GDSN-certified data pool, accounting for the vast majority of GTINs in the GDSN, more than all other GDSN-certified data pools combined. That said, 1SYNC is being transformed to meet the overall product data management needs of their thousands of customers. Changes include enhanced product and service offerings for new product introduction, improved data quality, and consumer-centric views of the structured and unstructured product data. It also means the creation of a significantly enhanced technical architecture/platform that provides the infrastructure needed for the development and management of consumer-centric views of product data keyed to GS1 Identifiers. This represents a major investment by 1SYNC to meet the needs of their customers in this rapidly evolving discipline.

It's interesting to note that a recent research report identified the Chief Marketing Officer (CMO) as opposed to the CIO as likely to be the person with the highest IT spend in most commercial organizations by 2017. Thus, the importance of the consumer-centric view and 1SYNC's investment in this area seems to be validated. 1SYNC is committed to being a world thought and practice leader in the area of product data management, not just a data pool. They are actively moving in this direction with not only new technical developments, but also major investments in professional services staff capabilities.

I interviewed Voltmer on February 9, 2012. He told me that a few years ago, a data pool was little more than the choreography of data movement between trading partners. What the community has told 1SYNC they need is a vision and path for making product data an asset to their businesses. They need to see how they can use all areas of product-related data to impact top and bottom lines. To do so, this data must move beyond the traditional logistics-related data associated with the GDSN. It must even move beyond the rich content data associated with B2B, B2C, and e-tailing requirements to a consumer-centric view of product data that includes social media (Facebook, Twitter, etc.), types of information that provide consumer-centric views keyed to products by GS1 standards, and the technical architecture to allow organizations to effectively gather, manage, and use this data.

As a result of these needs, 1SYNC is expanding the vision, detailed implementation, and advisory services around what GS1 standards and 1SYNC can offer a business. This has caused 1SYNC to start an ambitious project: to build a platform of other product data types that are nonstandard into a common environment so organizations can gather a holistic view of the product based on the consumer. Voltmer says that, because the consumer is demanding this, companies need it. 1SYNC is thus expanding its existing platform and will provide a set of tools that allows retailers, distributors, and manufacturers to provide this "big data" view of consumers that the market demands.

Digging a level deeper, Voltmer says 1SYNC is developing the infrastructure that enables the gathering, consolidation, and movement of non-traditional data (nutritional, sustainability, consumer viewpoint, Facebook, Twitter, blogs, consumer commentary).

Voltmer says this data allows companies to more quickly see and react to trends that indicate pleasure or displeasure with a product. This consolidated view can really help brand owners. 1SYNC's effort to develop this functionality in a community/industry-based way lowers the cost of entry for members and reduces risk for each participant. Once consumers start to see trading partners react more quickly and accurately to their wishes, they will more actively participate in the process. Participation by the brand owner or retailer helps enable the brand owners and trading partners to respond to the needs of the consumer.

What 1SYNC has heard from the industry is they need to build the platform through which this data can flow from many sources, with the ability to tie it to unique GS1 identifiers and have the services to help companies with implementation. 1SYNC is committed to working closely with industry and communities to help define the data needed, the best methods for movement and transformation, and the best practices to implement the new model in companies. This will include a modern architecture via Web Services that allows the different pipes of data to feed into it as well as carry away widgets that can be used by 1SYNC clients. An example of a widget would be a real-time graphic of a product, showing the number of views it has received over a period of time, with the ability to be drilled down into or refined relative to a category or a geographic region so that a marketing professional can judge whether the SEO campaign has been effective.

The world of product data is changing rapidly. Voltmer stresses the importance of having a standardized platform any participant can access via generally accepted technical methods. GS1 and 1SYNC want to reduce complexity and syndicate risk. He says the key is to approach this as a platform, not an application.

Focus Sector Update for Healthcare, Foodservice, and Retail

Healthcare

GS1 Healthcare US was formed in January 2008 to support the U.S. healthcare industry's goals to improve patient safety and increase supply-chain efficiency through the adoption and implementation of global GS1 standards. GS1 US Healthcare now has 134 member companies and 459 participants representing most key participants in their supply chain. The main focus is now on standards adoption and implementation. Standards development work will continue, but it is GS1 Healthcare's view that the industry has reached a point at which local healthcare user groups and GS1 Member Organizations are driving adoption in their local communities.

To accelerate wide-scale adoption and implementation, industry-accepted "sunrise" dates were established to standardize location and product identification throughout the U.S. healthcare supply chain.

2010 GLN Sunrise called for the adoption of GS1 GLNs in lieu of custom account/location numbers to standardize healthcare location information by December 31, 2010. In late 2010, five of the nation's most prominent healthcare systems formed a partnership, Healthcare Transformation Group (HTG), to share best practices and accelerate the implementation of GS1 standards. Charter HTG members Geisinger Health System and Mercy Health System use Omnicell solutions to implement the GS1 standards for improved supply-inventory monitoring and efficient care.

2012 GTIN Sunrise calls for the adoption of GS1 GTINs in lieu of custom product numbers to standardize healthcare product identification by December 31, 2012. The 2012 GTIN Sunrise initiative also includes the use of the GS1 GDSN to store and communicate the associated product attributes of each GTIN.

Having attended GS1 US Healthcare meetings every six months for about the past five years, I would say the most significant news is that all indications are that FDA regulations on the Unique Device Identification (UDI) initiative may be coming sometime after the next U.S. Presidential election. This development is likely to move major healthcare manufacturers, distributors, GPOs, and providers (hospitals) to take real and concrete steps to clearly identify products in the medical and surgical supply chain using GS1 standards and to exchange a significant portion of this information via the GDSN. There are many other advances in healthcare. I have outlined these below. It is my opinion that, depending on what is in the regulation, this could be the biggest driver leading GS1 systems and GDSN adoption in healthcare.

To support the business needs for adoption, the GS1 Healthcare US Global Data Synchronization Network (GDSN) Workgroup has adopted the following strategy and plan:

- Develop a strategy for GDSN attributes that reduces barriers and drives increased usage.

- Finalize the subset (approximately 15) of the 35 global healthcare attributes to be utilized to drive early uptake.

- Work with the GS1 Global Office to develop and implement a technical solution that makes select mandatory attributes optional.

- Work with GS1 Healthcare to globally standardize healthcare attribute definitions.

- Modify the list of attributes based on UDI and GHTF announcements.

The 2015 Readiness Program for the U.S. pharmaceutical industry is a program that helps companies prepare for upcoming changes. Based on simulation methods, this program provides organizations an opportunity to prepare for product serialization and 2015 drug pedigree regulations, gain insights into the benefits of supply chain visibility with GS1 standards, drive industry practices, and make the decisions needed to be ready for 2015.

For more information, download the GS1 Healthcare Reference Book.

Foodservice

Industry organizations and founding members of the Foodservice GS1 US Standards Initiative cite three main objectives and industry-wide benefits as a result of companies choosing to adopt and implement GS1 standards:

- Drive waste out of the foodservice supply chain.

- Improve product information for customers.

- Establish a foundation for improving food safety and traceability.

Within the foodservice industry, GS1 standards have been endorsed by industry associations such as the International Foodservice Distributors Association (IFDA), the International Foodservice Manufacturers Association (IFMA), and the National Restaurant Association (NRA).

According to GS1 US Foodservice, the FDA supports the foodservice industry efforts to define product information using GS1 standards and exchange the information via the GDSN. The business reason for the initiative in foodservice is the ability to get data records electronically. Using global standards to identify products and tracking products globally fit with the FDA's efforts to effectively track and trace food products and address food safety issues.

Approximately two years after the initiative's launch, GS1 US says the industry is at about the 40% mark, with a goal of 75% voluntary adoption (measured by revenue) of GS1 standards by 2015. Since the initiative launch in October 2009, the number of foodservice companies subscribing to the GDSN has grown eightfold—from 191 in 2009 to 1,430 today. (Read the full story.)

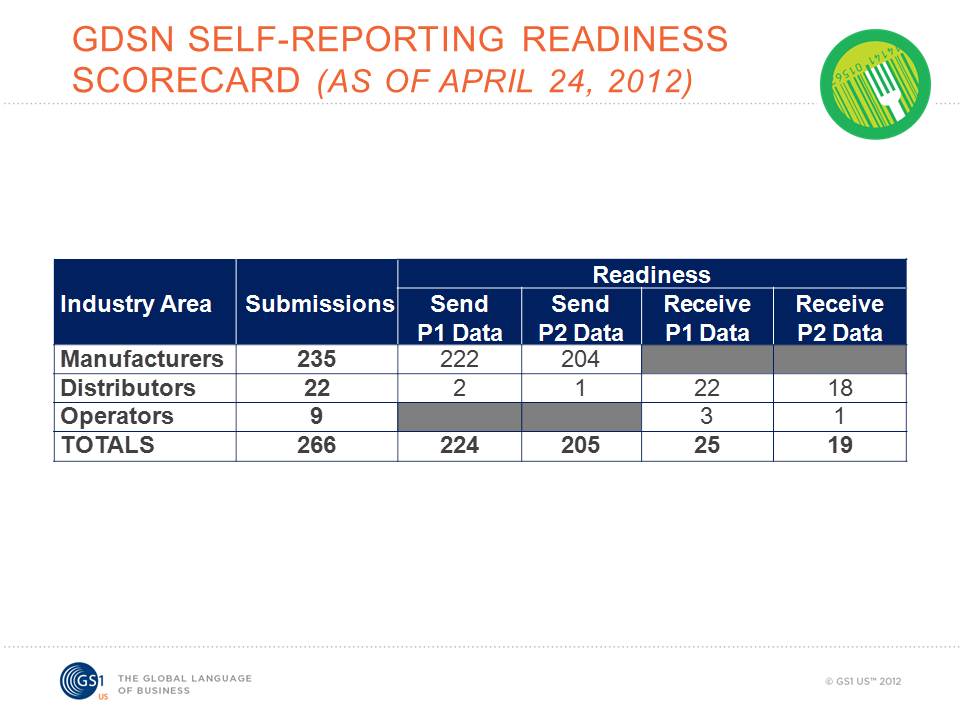

Figure 1: GS1 system readiness continues to grow in the foodservice industry.

The foodservice industry is moving forward toward adopting GS1 Standards. As shown in Figure 1 above, the readiness scorecard reporting continues to grow. The readiness scorecards provide foodservice companies with a means to voluntarily share their GDSN activity status and to see which trading partners are ready to send and receive Phase 1 and Phase 2 data. Participation in scorecard reporting is voluntary. Companies are asked to update the scorecards quarterly.

Current results show that 223 manufacturers are now reporting their status. This is a 22% percent rise in the last 60 days. More than 500 manufacturers are currently involved in standards adoption, but not all of them have started participating in the voluntary scorecard process. GS1 US asks manufacturers not yet reporting to consider doing so to accurately depict activity in the standards initiative. Currently, 92% of manufacturers that submitted scorecards are "Ready to Send Phase 1 Data" and 81% are "Ready to Send Phase 2 Data."

At this time, 54% of distributors that submitted scorecards are ready to receive both Phase 1 and Phase 2 data. Foodservice distributors are finding that industry standards provide safer food and also remove waste and costs to produce a more efficient supply chain.

Retail

Item-level tagging in apparel is heating up. In the past 18 months, the clothing and shoe sector has seen an upsurge in full-scale deployments of Radio Frequency Identification (RFID), and the benefits are starting to become very clear. These industries provide large ranges of sizes, colors, and styles, with short product lifecycles due to seasons and fashion. Production is often in Asia for sale in the U.S. and Europe. Trading partners in the apparel supply chain struggle with inventory nightmares: out-of-stock crises, shipping and receiving headaches, shrinkage issues, and tight go-to-market timelines. RFID can provide excellent solutions to all of these pain points.

Jones Apparel Group, Macy's, Dillard's, JC Penney, Gap, Banana Republic, Marks & Spencer, Bloomingdale's, and Gerry Weber are among the companies that have already begun RFID deployments. These businesses are finding that RFID greatly helps reduce the time their staffers spend searching for a certain size or model in a storeroom. RFID also reduces time spent receiving goods at the store and the time required to perform cycle counts. Finally, RFID brings huge improvement in inventory accuracy, bringing accuracy to over 95% compared to an industry average of 62%. And with RFID deployed, stores can take inventory as often as they wish. Sixty unique business cases for RFID in apparel have been identified by the University of Arkansas (download the free report).

GS1 US RFID leader Pat Jarvik says, "Apparel and footwear companies are turning to Electronic Product Code (EPC)-enabled RFID to make their supply chains more agile and provide better service and selection to their customers. Suppliers and retailers alike are using the visibility gained by item-level RFID to improve inventory accuracy and management, reduce shrinkage, improve forecasting, and take unnecessary time and cost out of operations."

GS1 US notes that with this technology, companies can accurately determine the status of every single product, from production to point-of-sale. Thus, EPC-enabled RFID is a great fit for the apparel industry (and assumedly many others) because it helps keep the right products at the right inventory levels and helps move them quickly onto sales floors. This in turn helps apparel manufacturers, retailers, and their logistics partners to more accurately forecast customer demand and quickly get products to market. The combination of the GS1 System and RFID technology gives apparel companies the tools needed to profitably integrate EPC-enabled RFID into their business operations.

The GS1 Retail and Consumer Goods Newsletter recently published an article titled "What's ahead for RFID in Retail & Consumer Goods?" The article noted that RFID Journal founder and editor, Mark Roberti, said that retailers and manufacturers of consumer packaged goods were among the leaders in exploring the benefits of tracking cases and pallets using RFID systems based on EPC standards. Those pioneering efforts didn't bear fruit; the technology was perceived as too costly and challenging to deploy and didn't get the backing of enough retailers. However, Roberti pointed out, things are changing, and retailers and CPG companies are taking another look at RFID. "Mass merchandise retailers, department stores and specialty chains have been deploying RFID to track clothing items," Roberti said. "The big benefits are improved inventory accuracy and better replenishment, which leads to more sales. Clothing is ideally suited to tracking with RFID because it is RF-friendly so read rates are extremely high, and there are many sizes, colors, and styles, which makes tracking inventory with bar codes a challenge."

Roberti feels the adoption of RFID to track clothing is driving the cost of tags down and improving the sophistication of readers, which makes it easier for CPG companies to deploy the technology. Most are looking at tagging the more expensive items, items that are often out of stock (such as razor blades and batteries), or items with high shrinkage rates: "But this time, as companies go to deploy, the technology is better and they have more experience about how and where to use RFID to drive business benefits."

Conclusion

My last four articles have been about the advances in GS1 Item Alignment via the GDSN. There have been a lot of graphs and charts showing advances in adoption in terms of numbers of GTINs, GLNs, subscription matches, etc. There have been sections covering focus areas such as data quality. I intended to do a similar update this time. I even started writing the article in this manner, gathering statistics, etc. After reading it several times, it became clear this was not the real story here. Yes, the prevalence of GS1 standards as the language of business is broadening, as is the use of GS1 methods for communicating and synchronizing this critical business information. But what became clear to me this time was that the real story is how GS1 US has changed from a traditional non-profit organization to a dot-org run by strong, commercially experienced professionals who are developing meaningful new capabilities and programs to bring the benefits of standards to life in major companies and critical supply chains. The advances in healthcare, foodservice, and retail are all exciting to see. The development of a new platform that will allow a consumer-centric view of products could change the lives of product managers and consumers alike. GS1's efforts to bring the benefits of standards to life with new advisory services can have real benefits for companies and consumers alike.

I can't wait to write the next article in 18 months or so. If the topic of GS1 and 1SYNC interests you, the reader, as much as it does me, please get involved.

Business users want new applications now. Market and regulatory pressures require faster application updates and delivery into production. Your IBM i developers may be approaching retirement, and you see no sure way to fill their positions with experienced developers. In addition, you may be caught between maintaining your existing applications and the uncertainty of moving to something new.

Business users want new applications now. Market and regulatory pressures require faster application updates and delivery into production. Your IBM i developers may be approaching retirement, and you see no sure way to fill their positions with experienced developers. In addition, you may be caught between maintaining your existing applications and the uncertainty of moving to something new. IT managers hoping to find new IBM i talent are discovering that the pool of experienced RPG programmers and operators or administrators with intimate knowledge of the operating system and the applications that run on it is small. This begs the question: How will you manage the platform that supports such a big part of your business? This guide offers strategies and software suggestions to help you plan IT staffing and resources and smooth the transition after your AS/400 talent retires. Read on to learn:

IT managers hoping to find new IBM i talent are discovering that the pool of experienced RPG programmers and operators or administrators with intimate knowledge of the operating system and the applications that run on it is small. This begs the question: How will you manage the platform that supports such a big part of your business? This guide offers strategies and software suggestions to help you plan IT staffing and resources and smooth the transition after your AS/400 talent retires. Read on to learn:

LATEST COMMENTS

MC Press Online