Until the 1990s, banking at the company level was heavily oriented to paper and the protection of check paper and other banking documents. The advent of electronic documents was embraced by the banking industry through the Electronic Payments Association that publishes the electronic banking payments standard for the United States (formerly called the National Automated Clearinghouse Association)—still called NACHA. It is a not-for-profit association that represents more than 11,000 financial institutions and 650 organizations through industry councils.

NACHA develops rules and practices for the Automated Clearing House (ACH) Network and an array of electronic type payments. The ACH Network is a payments network that provides the capability to transfer funds to your company's own bank accounts, clients, vendors, and employees without the wait and hassle of traditional paperwork. In 2005, the number of checks converted to ACH debits increased by 60 percent and the ACH network processed more than 2.2 billion consumer bill payments.

This electronic transfer of payment and deposit information permits tighter security over banking data and moves the money faster through the system. This has led to depositing receivables faster, paying payables on the exact date they are due, and getting employees paid directly into their personal or family checking accounts.

What is ACH?

ACH is a nationwide central clearing facility that processes your electronic banking transactions. The software runs on most commercial computers. There are several ACH software products that run on the AS/400/iSeries/System i, one of the most stable platforms available, a requirement for banking transactions. This "e-banking" software simply receives your company's electronic, pre-authorized debit and credit payments from your bank and routes them to the designated receiving banks.

ACH has permitted companies to transfer a wide variety of funds safely, reliably, and conveniently for years. With ACH you can transfer funds from your company's account to be used for your payroll, travel and expense reimbursements, bill payments, retail purchases, Internet purchases, corporate payments, treasury management, annuities, and pensions, dividends, and government payments such as Social Security and veterans benefits.

Standard characteristics of ACH software generally fall into the following areas:

Functions

- Direct Deposit: Payments to your vendors, employees, and others. Automatically debit your customers recurring bills (they no longer will need to write and mail you checks, the ACH software takes care of it electronically). Also receive deposits from direct deposit of payroll, Social Security, and other government benefits.

- Direct Payments: ACH payments include tax refunds; direct payment of bills such as mortgages, loans, utility bills, and insurance premiums; business-to-business payments; e-checks; federal, state, and local tax payments.

- Funds Transfers: Transfer funds electronically between accounts.

- E-commerce: Electronic payments for shopping cart purchases online.

Benefits

- Consolidation: Bring together your bank accounts through cash concentration and disbursement.

- Speed: Reduce the processing time and related costs associated with traditional paper-based accounts receivable from your trading partners.

Features

- Notification: E-mail notification of deposits.

- Monitoring: Extensive tracking and reporting features.

- Integration: Often integrates with other e-doc software offered by the software vendor.

- Security: Electronic management of funds reduces the risk of theft and fraud.

The NACHA Web site (http://www.nacha.org/) says the following:

The ACH Network is a highly reliable and efficient nationwide batch-oriented electronic funds transfer system governed by the NACHA Operating Rules, which provide for the interbank clearing of electronic payments for participating depository financial institutions. The Federal Reserve and Electronic Payments Network act as ACH Operators, central clearing facilities through which financial institutions transmit or receive ACH entries.

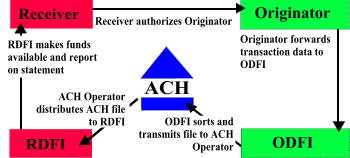

The NACHA Web site also offers the following chart, Figure 1,of the ACH check clearing house system.

Figure 1 shows the flow for e-banking transfers using the ACH Network. Above, the Originator is any individual, corporation, or other entity that initiates entries into the Automated Clearing House Network. The Receiver is the recipient of funds transferred through ACH. ODFI is the originating depository financial institution. RDFI is the receiving depository financial institution (click image to enhance).

Readers can learn more about ACH by looking up the terms in this article with your favorite search engine. The author is always available to answer questions about ACH or other areas of electronic document management.

Dan Forster is president of inFORM Decisions, a company he founded after 20 years working with various electronic document management solutions. Dan was part of a team that introduced the first implementations of AS/400 laser form, check, and printer connectivity solutions to IBM midrange users in the mid 1980s. His company was one of the first to implement a comprehensive iSeries host-based e-document distribution system powered by intelligent routing capabilities for fax, email, archive-retrieve, and laser forms. The company's current ACH applications include iSeries ACH and iSeries Positive Pay. Dan is a former collegiate All American Athlete who holds a BS in marketing and business management from Cal State Long Beach and has completed numerous CEO and management certification courses. Dan can be reached at

More than ever, there is a demand for IT to deliver innovation. Your IBM i has been an essential part of your business operations for years. However, your organization may struggle to maintain the current system and implement new projects. The thousands of customers we've worked with and surveyed state that expectations regarding the digital footprint and vision of the company are not aligned with the current IT environment.

More than ever, there is a demand for IT to deliver innovation. Your IBM i has been an essential part of your business operations for years. However, your organization may struggle to maintain the current system and implement new projects. The thousands of customers we've worked with and surveyed state that expectations regarding the digital footprint and vision of the company are not aligned with the current IT environment. TRY the one package that solves all your document design and printing challenges on all your platforms. Produce bar code labels, electronic forms, ad hoc reports, and RFID tags – without programming! MarkMagic is the only document design and print solution that combines report writing, WYSIWYG label and forms design, and conditional printing in one integrated product. Make sure your data survives when catastrophe hits. Request your trial now! Request Now.

TRY the one package that solves all your document design and printing challenges on all your platforms. Produce bar code labels, electronic forms, ad hoc reports, and RFID tags – without programming! MarkMagic is the only document design and print solution that combines report writing, WYSIWYG label and forms design, and conditional printing in one integrated product. Make sure your data survives when catastrophe hits. Request your trial now! Request Now. Forms of ransomware has been around for over 30 years, and with more and more organizations suffering attacks each year, it continues to endure. What has made ransomware such a durable threat and what is the best way to combat it? In order to prevent ransomware, organizations must first understand how it works.

Forms of ransomware has been around for over 30 years, and with more and more organizations suffering attacks each year, it continues to endure. What has made ransomware such a durable threat and what is the best way to combat it? In order to prevent ransomware, organizations must first understand how it works. Disaster protection is vital to every business. Yet, it often consists of patched together procedures that are prone to error. From automatic backups to data encryption to media management, Robot automates the routine (yet often complex) tasks of iSeries backup and recovery, saving you time and money and making the process safer and more reliable. Automate your backups with the Robot Backup and Recovery Solution. Key features include:

Disaster protection is vital to every business. Yet, it often consists of patched together procedures that are prone to error. From automatic backups to data encryption to media management, Robot automates the routine (yet often complex) tasks of iSeries backup and recovery, saving you time and money and making the process safer and more reliable. Automate your backups with the Robot Backup and Recovery Solution. Key features include: Business users want new applications now. Market and regulatory pressures require faster application updates and delivery into production. Your IBM i developers may be approaching retirement, and you see no sure way to fill their positions with experienced developers. In addition, you may be caught between maintaining your existing applications and the uncertainty of moving to something new.

Business users want new applications now. Market and regulatory pressures require faster application updates and delivery into production. Your IBM i developers may be approaching retirement, and you see no sure way to fill their positions with experienced developers. In addition, you may be caught between maintaining your existing applications and the uncertainty of moving to something new. IT managers hoping to find new IBM i talent are discovering that the pool of experienced RPG programmers and operators or administrators with intimate knowledge of the operating system and the applications that run on it is small. This begs the question: How will you manage the platform that supports such a big part of your business? This guide offers strategies and software suggestions to help you plan IT staffing and resources and smooth the transition after your AS/400 talent retires. Read on to learn:

IT managers hoping to find new IBM i talent are discovering that the pool of experienced RPG programmers and operators or administrators with intimate knowledge of the operating system and the applications that run on it is small. This begs the question: How will you manage the platform that supports such a big part of your business? This guide offers strategies and software suggestions to help you plan IT staffing and resources and smooth the transition after your AS/400 talent retires. Read on to learn:

LATEST COMMENTS

MC Press Online